Quick Cash, Zero Credit Checks: Getting an Emergency Loan in Australia

When life throws unexpected expenses your way, having access to quick cash can make all the difference. In Australia, there are now options for emergency loans that don’t require a credit check, designed to help those facing urgent financial situations. Here’s how these loans work and what you need to know to get started.

Why Consider an Emergency Loan?

Whether it's a medical expense, urgent repair, or simply making ends meet until your next paycheck, an emergency loan can provide much-needed support without lengthy approval processes. Unlike traditional bank loans, which often require good credit, these options are more flexible and accessible, making them ideal for anyone who needs cash fast.

Benefits of No Credit Check Loans

1.Quick and Easy Approval: One of the biggest advantages is the speed of approval. With no credit check required, lenders can process your application and release funds much faster.

2.Accessible to All: These loans are available to Australians with varying credit histories, meaning that even if you have a low credit score, you’re still eligible to apply.

3.Flexible Amounts: Loan amounts can range from a few hundred to several thousand dollars, making it possible to tailor the loan to suit your exact needs.

4.Minimal Requirements: Unlike traditional loans, which often require extensive documentation, these emergency loans have minimal requirements. Many lenders offer options without employment verification, making them accessible to freelancers, contractors, and those between jobs.

Who Can Apply?

Almost any adult resident of Australia can apply for an emergency loan. Typically, lenders only require that applicants:

Are at least 18 years old.

Have a regular income source (this can be through employment or government benefits).

Hold an active Australian bank account.

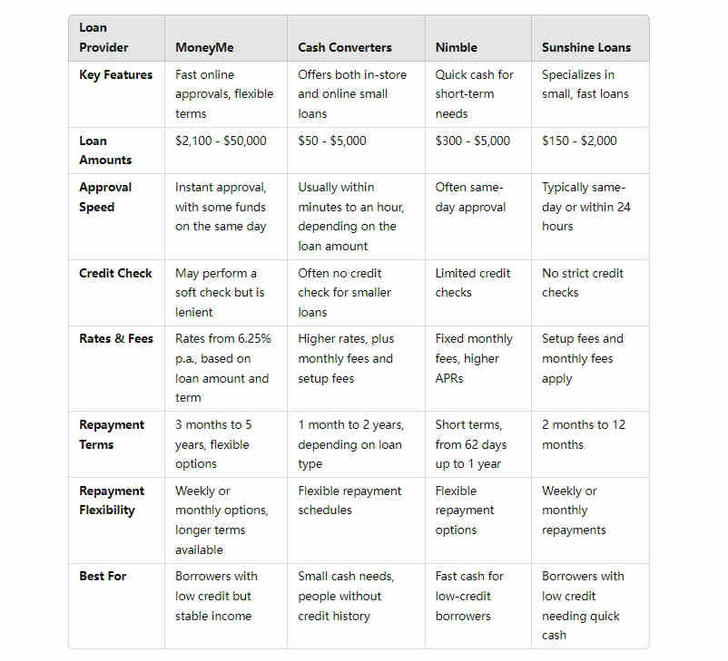

Comparison of Top Emergency Loan Providers in Australia

To help you find the best fit, here’s a comparison of some of the top non-traditional loan providers offering emergency loans in Australia.

Choosing the Right Loan Provider

Consider Loan Amount Needs:

For larger loans, MoneyMe offers up to $50,000 and may be better suited for bigger expenses.

For smaller amounts, Cash Converters and Sunshine Loans are ideal for short-term, small cash needs.

Approval Speed & Convenience:

If you need cash urgently, Nimble and Sunshine Loans are known for quick approval, often within the same day.

Cash Converters offers both online applications and in-store service, ideal if you prefer face-to-face interaction.

Repayment Flexibility:

If you need a longer repayment period, MoneyMe offers terms of up to 5 years, allowing for lower monthly payments.

For shorter-term needs, Sunshine Loans and Nimble’s repayment terms are more flexible, suitable for short-term borrowers.

Watch for Fees:

Emergency loans without credit checks often come with higher fees. Carefully review the terms, including setup and monthly fees, before committing.