How to Buy Foreclosed Properties at a Low Price

Foreclosed properties, or homes sold at auction by the court, are usually sold at prices below market value, which attracts many investors. However, there are certain risks in buying foreclosed properties that need to be carefully considered.

Why is a home foreclosed?

•Debt default: The homeowner may be unable to repay the loan or debt, resulting in the court auctioning the property.

•Legal disputes: Legal issues involving the property may lead to a court-ordered sale.

Foreclosure Auction Process

There are two main types of foreclosure auctions:

•Open auctions: Participants can see other bids in real time and continue to raise their bids.

•Sealed bid auctions: Participants submit bids in sealed envelopes, and the highest bidder wins.

Things to consider when attending an auction

•Understand local auction rules: Auction rules vary from place to place, so it is important to know them in advance.

•Prepare enough funds: Auctions usually require cash payment, and the winning bidder must pay immediately.

•Conduct a property survey: There may be hidden problems with a foreclosed property, so it is recommended to hire a professional to inspect the property.

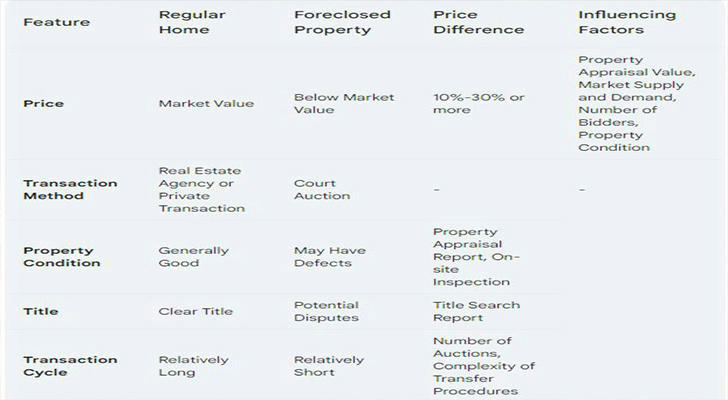

Risks of Buying Foreclosed Properties

•Unknown Property Condition: The property may have structural or maintenance issues.

•Title Disputes: There may be unresolved debts or title disputes.

•Complex procedures: The process of transferring foreclosed properties can be complicated.

Advantages of Buying Foreclosed Properties

•Low Price: Often sold at below market value.

•Investment Potential: Potential for high returns.

How to Find Foreclosed Properties

•Local Court Websites: Most courts publish foreclosed property information.

•Property Auction Websites: Professional platforms provide more comprehensive information.

•Real Estate Agents: They can provide professional advice and help.

Buying Tips

•Consult Professionals: Attorneys and Real Estate Agents can provide expert guidance.

•Compare Multiple Properties: Don't rush, view multiple properties before making a decision.

•Set a Reasonable Budget: Avoid overpaying.

•Be Prepared: Foreclosed properties are risky, so be prepared for potential challenges.

Case Study:

Buying an Antique House Jason has always loved antique houses, but the high prices in the city center have deterred him. One day, he happened to see an antique house in the city center on an auction website. Although the exterior is a bit shabby, the location is excellent and the starting price is much lower than the market price.

After careful inspection and evaluation, Jason found that the old house needed extensive repairs, but its architectural structure and historical value were considerable. After fierce bidding, Jason successfully bought the old house at a price 30% below the market price. After a year of careful renovation, Jason transformed the old house into a unique boutique bed and breakfast and received rich returns.

Note

•Ensure sufficient cash: Auctions usually require cash payment.

•Understand local laws and regulations: Foreclosure policies vary from region to region.

•Pay attention to deadlines: There is usually a time limit to complete the transfer after the auction.

Conclusion

Buying foreclosed properties can bring considerable returns on investment, but it also comes with risks. Before deciding to buy, be sure to thoroughly understand the process, carefully evaluate the property, and seek professional help.