No Income Verification Loans in Canada: Quick and Accessible Emergency Cash

In Canada, no income verification loans are an option for individuals who need urgent funds but don't have proof of income readily available. These types of loans are ideal for those who may be self-employed, freelancers, or in between jobs and require immediate financial assistance. Here’s everything you need to know about no income verification loans in Canada, including their benefits, key lenders, and a comparison of their features.

Why Choose a No Income Verification Loan?

No income verification loans offer a range of benefits, making them an excellent choice in times of financial need. Here are a few reasons why you might opt for these loans:

1.Quick Access to Funds: Traditional loans often require extensive documentation, including proof of income, which can delay the approval process. No income verification loans have a simpler application process, which allows for faster approval and quick access to funds, sometimes within a few hours.

2.Minimal Documentation: These loans usually require only basic identification, making them perfect for individuals who might not have the traditional documents needed to apply for a bank loan, such as pay stubs or tax returns.

3.Accessible for People with Irregular Income: Whether you’re self-employed, a contractor, or working part-time, no income verification loans are available to those who have non-traditional income sources or inconsistent pay.

4.Emergency Situations: No income verification loans are an ideal solution when you need money urgently for medical bills, car repairs, or unexpected expenses. These loans are designed for short-term financial needs that require quick resolutions.

5.Flexible Loan Amounts and Repayment Terms: Many lenders offer a range of loan amounts and flexible repayment options, which makes these loans adaptable to different needs. Whether you need a small loan for a couple of weeks or a larger loan for several months, these loans are customizable.

Key Benefits of No Income Verification Loans

1.Faster Approval: No income verification loans are usually processed faster than traditional loans, making them an excellent choice for urgent financial situations. This means you can get approved and receive your loan within hours or even the same day.

2.No Proof of Employment Required: These loans often do not require proof of employment or regular income, making them accessible for freelancers, self-employed individuals, or people with irregular jobs.

3.Helps Those with Low Credit Scores: For individuals with less-than-perfect credit, no income verification loans can be a good option. Since these loans don’t focus on income or credit scores, they may be available to borrowers who might otherwise struggle to qualify for traditional loans.

4.Flexible Loan Amounts: No income verification loans typically range from smaller, short-term loans for urgent needs to larger, more flexible loans for bigger expenses. Whether you need a few hundred dollars or a larger sum, you can usually find a loan that suits your needs.

5.Accessible for a Variety of People: People in different financial situations, including students, retirees, and low-income earners, can benefit from these loans without needing to meet stringent requirements.

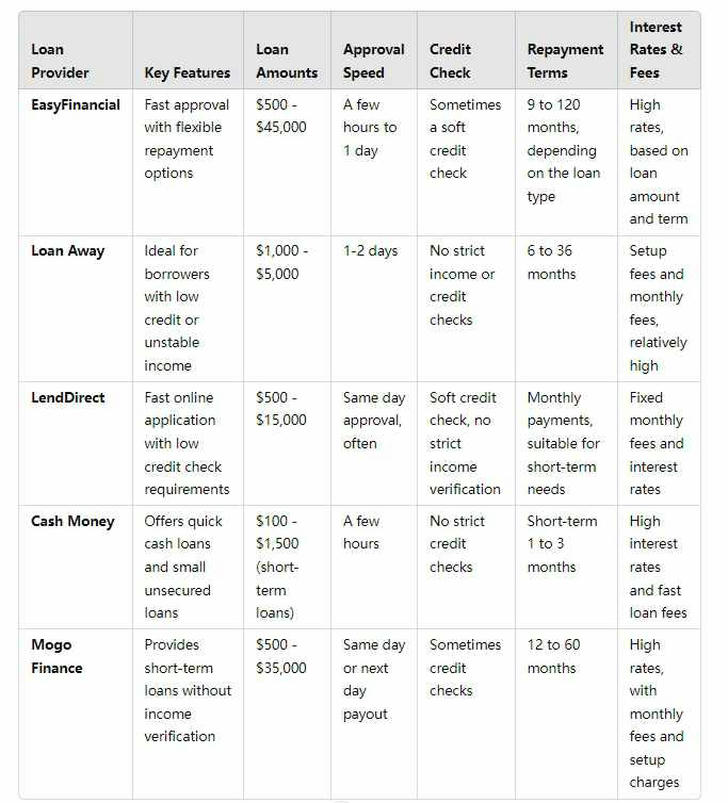

Comparison of Top No Income Verification Loan Providers in Canada

Here’s a comparison of some of the most popular no income verification loan providers in Canada. Each provider has different loan amounts, terms, and approval speeds to suit various needs.

How to Choose the Right Loan Provider?

1.Loan Amount:

If you need a larger loan, EasyFinancial and Mogo Finance can lend up to $45,000 and $35,000, respectively, making them suitable for major expenses.

For smaller, short-term loans, Cash Money and LendDirect are ideal options, with amounts starting at $100 and up.

2.Approval Speed:

Cash Money and LendDirect are some of the fastest providers, often providing approval within hours or the same day.

EasyFinancial and Loan Away take 1-2 days for approval, so these may be better for less urgent situations.

3.Repayment Flexibility:

EasyFinancial offers longer repayment terms, which may be more suitable for larger loans or those looking to spread out payments.

LendDirect and Cash Money offer shorter repayment options, ideal for smaller loans with faster payoffs.

4.Interest Rates and Fees:

All no income verification loans come with relatively high interest rates and fees, due to the increased risk for lenders. Make sure to compare rates between providers before committing to a loan.

Mogo Finance and Loan Away offer rates based on the loan amount and term, but some providers may charge additional setup or monthly fees.

Conclusion

No income verification loans provide a quick and accessible way to obtain funds in times of need, without requiring proof of income or employment. These loans are ideal for individuals with irregular income, low credit scores, or those in urgent financial situations. While these loans come with higher interest rates, they offer fast approval, minimal documentation, and flexible loan amounts to suit various needs. When selecting a lender, be sure to consider your loan amount needs, approval speed, repayment terms, and associated fees to find the option that works best for you.